Naked Capitalism has a great post up on some of the problems with the maximizing shareholder value theory of corporate governance. Put simply, maximizing shareholder value is an academic theory that went mainstream. In practice it has proven to be a terrible paradigm for corporate governance but powerful interests insist on keeping it this way despite shareholders having nothing but a residual legal claim.

To build on this, I think that concepts like maximizing shareholder value are at the root of what is wrong with our social system. It creates bad incentives and decays the culture and morals. I've been reflecting on these issues quite a bit since starting my MBA program; something I noticed very quickly is that compared to my previous studies there is little effort being made to question the root assumptions or to consider what impact these assumptions are having on behavior.

To start with, maximizing shareholder value is one of the more obvious giveaways of the authoritarian ideology at the root of our supposedly free market right wing. There is no good objective reason why maximizing shareholder value should be a priority of corporations in a free market, other stakeholders, especially employees but also customers and suppliers, have much more powerful and pressing interests in the good governance of corporations. Shareholders often have interests at odds with other stakeholders in a corporation yet those that claim to be in favor of free markets uphold norms that favor these modern absentee landlords over stakeholders with a far greater stake and stronger incentives to make a business run well and profitably. Unless a business anticipates a near term need to raise greater equity financing there is no reason to put shareholders anywhere but last among the various stakeholders, yet our system favors the capitalists over the rest. This leads to an upward distribution of wealth and makes our corporations less competitive than earlier doctrines of corporate governance which emphasized shareholders less.

Another issue is that it gives managers interests and incentives that are often at odds with the wellbeing of the members composing the organization they manage. In just about any other organization the members that compose that organization are regarded as effectively being that organization, yet, with the maximizing shareholder value theory of corporate governance the actual employees that make up the organization are often rated no higher than the plant and equipment the corporation owns. Since we do know that how organizations are conceived of and how members relate to each other is important for organizational functioning it should be obvious that this doesn't maximize organizational effectiveness. The idea that an organization can be "owned" distinctly from the members composing it should seem a bit odd to us, especially since the ownership adds no value beyond the ability to occasionally raise capital. That it doesn't is an indictment on our culture.

These two issues are enough for a quick post. This is a subject I'll probably have more to right about later. Something that I didn't expect to happen when I started a business program was that it would make me think more about whether or not capitalism is actually a useful concept. Seeing the number of unexamined assumptions in my business classes is making me think that it just might be something useful. There is certainly something distinct about an ideology that places owners above workers despite this relationship being inefficient and corrosive to good organizational behavior. Free markets certainly don't demand these relationships. That they exist argues in favor of a distinct capitalist ideology with essentially authoritarian roots that undermines free market institutions in the interests of siphoning wealth and political power towards the top. This needs more thinking on my part but I'm coming around to the idea that there is something to the Marxist notion of capitalism, provided that the Smithian idea of the free market is retained as the proper comparison point to diagnose the evils of capitalism rather than some sort of fantastical socialist utopia.

Monday, October 21, 2013

Wednesday, October 16, 2013

Assumptions Must Be Grounded to Get Accurate Results

Not Quite Noahpinion has a great post on what's wrong with economics aside from rational expectations. There are two points made that I'd like to elaborate on a bit.

This is a major point that frustrates me with economics. In political science there is a lot of open derision about this point, though these assumptions can be useful for specific purposes and continue to be used by certain narrow approaches (most notably, public choice approaches). As Peter Dorman says, it's an 18th century idea that has long been superseded by further research. It's not just wrong, we know its wrong. Yet, economists still use it and don't seem to acknowledge this.

When choosing your starting assumptions (assumptions must be made for any real analysis), it's essential to choose those assumptions based on your best read of the available evidence. Since the study of human psychology is outside the realm of economics they should be drawing their behavioral assumptions from other disciplines, like psychology and neuro-biology. This is happening to a certain extant but what needs to happen is that the assumption of individual, autonomous units is ejected wholesale as it has been done in other disciplines.

5. There is no interdependence among individuals or firms other than what is channeled through the market. Everything else is a matter of simply adding up: me plus you plus her plus Microsoft plus the local taco truck. We live in isolated worlds, only connecting through the effects of our choices on the prices others face in the market. This assumption denies all the other ways we affect one another; it is very eighteenth century. In all other social sciences it has disappeared, but in economics it rules. Yet non-market interconnections matter mightily at all levels. There are discourses in asset markets, for instance: different narratives that compete and draw or lose strength from the choices made by market participants and the reasons they give for them. Consumption choices are profoundly affected by the consumption of others—this is what consumption norms are about. The list of interactions, of what makes us members of a society and not just isolated individuals, is as long as you care to make it. Technically, the result is indeterminacy---multiple equilibria and path dependence—as well as the inability to interpret collective outcomes normatively (“social optima”). Also, such models quickly become intractable.

This is a major point that frustrates me with economics. In political science there is a lot of open derision about this point, though these assumptions can be useful for specific purposes and continue to be used by certain narrow approaches (most notably, public choice approaches). As Peter Dorman says, it's an 18th century idea that has long been superseded by further research. It's not just wrong, we know its wrong. Yet, economists still use it and don't seem to acknowledge this.

When choosing your starting assumptions (assumptions must be made for any real analysis), it's essential to choose those assumptions based on your best read of the available evidence. Since the study of human psychology is outside the realm of economics they should be drawing their behavioral assumptions from other disciplines, like psychology and neuro-biology. This is happening to a certain extant but what needs to happen is that the assumption of individual, autonomous units is ejected wholesale as it has been done in other disciplines.

6. Rational decision-making takes the form of maximizing utility. Utility maximization is a representation of rational decision-making in a world in which only outcomes count and all outcomes are commensurable. This is another eighteenth century touch, this time at the level of individual psychology. Today almost no one believes this except economists. It is not a matter of whether people are rational, by the way, but what the meaning and role of rationality is. It is not irrational to care about processes as well as outcomes, or to recognize that some outcomes do not trade off against others to produce only a net result. (This is what it means to be torn.) The utilitarian framework is a big problem in a lot of applied micro areas; it is less clear what damage it does in macro. I suspect it plays a role in wage-setting and perhaps price setting in contexts where long-term supplier-customer relationships are established. We have a few models from the likes of George Akerlof that begin to get at these mechanisms, but their utilitarian scaffolding remains a constraint.Another area where economists are badly out of date. People care about more than outcomes and people do more than maximize. How you get there can be as important as where you're going. Another well established point often ignored by economists. Other social sciences embraced this notion decades ago, economists should catch up (and some are doing so).

Things Economists Write that Make Me Doubt Economics as Practised is a Science

I was reading a post on Mainly Macro which really brought out some of the assumptions that economists have that raise doubts about whether what they're doing is really a science. I will quote the problematic passages (most critical text in bold):

And later on:

Do you notice the discrepancy? In the formal scientific method external validity is the be all and end all of the scientific method. Internal validity is only the scientific in the sense that Marxism is "scientific socialism." Internal validity is the mark of pseudo-science, it's a large part of what marks the dividing line between the two. It's nice when theories are internally consistent but most often they are not in the early stages. Internal validity gets added as a natural part of the research project (think developments in the theory of evolution); trying to force internal validity is a mistake that will rapidly push a theory away from science and into the realm of pseudo-science. Let it happen naturally as more observations come in and more parts of the theory are tested more rigorously.

As a side note, I do have to express my dissatisfaction with the emphasis on experiments, no one disputes that astronomy is a science and experiments are very rarely possible. Testable predictions and observations are the true benchmark, in astrophysics if I predict a black hole will show up in certain conditions and further observations do indeed confirm that black holes do show up in those conditions I've successfully made a testable hypothesis and confirmed it without experimentation, if it doesn't show up than I have evidence against my hypothesis. Same thing with economics.

For those who are not economists, let’s be clear what the microfoundations project in macro is all about. The idea is that a macro model should be built up from a formal analysis of the behaviour of individual agents in a consistent way. There may be just a single representative agent, or increasingly heterogeneous agents. So a typical journal paper in macro nowadays will involve lots of optimisation by individual agents as a way of deriving aggregate relationships.

And later on:

The trouble with this approach, as New Classical economists demonstrated, was that the theoretical rationale behind equations often turned out to be inadequate and inconsistent. The Lucas critique is the most widely quoted example where this happens. So the microfoundations project said let’s do the theory properly and rigorously, so we do not make these kind of errors. In fact, let’s make theoretical (‘internal’) consistency the overriding aim, such that anything which fails on these grounds is rejected. There were two practical costs of this approach. First, doing this was hard, so for a time many real world complexities had to be set aside (like the importance of banks in rationing credit, for example, or the reluctance of firms to cut nominal wages). This led to a second cost, which was that less notice was taken of how each aggregate macro relationship tracked the data (‘external’ consistency). To use a jargon phrase that sums it up quite well: internal rather than external consistency became the test of admissibility for these models.Now let's review the scientific method:

I. The scientific method has four steps

1. Observation and description of a phenomenon or group of phenomena.

2. Formulation of an hypothesis to explain the phenomena. In physics, the hypothesis often takes the form of a causal mechanism or a mathematical relation.

3. Use of the hypothesis to predict the existence of other phenomena, or to predict quantitatively the results of new observations.

4. Performance of experimental tests of the predictions by several independent experimenters and properly performed experiments.

If the experiments bear out the hypothesis it may come to be regarded as a theory or law of nature (more on the concepts of hypothesis, model, theory and law below). If the experiments do not bear out the hypothesis, it must be rejected or modified. What is key in the description of the scientific method just given is the predictive power (the ability to get more out of the theory than you put in; see Barrow, 1991) of the hypothesis or theory, as tested by experiment. It is often said in science that theories can never be proved, only disproved. There is always the possibility that a new observation or a new experiment will conflict with a long-standing theory.

Do you notice the discrepancy? In the formal scientific method external validity is the be all and end all of the scientific method. Internal validity is only the scientific in the sense that Marxism is "scientific socialism." Internal validity is the mark of pseudo-science, it's a large part of what marks the dividing line between the two. It's nice when theories are internally consistent but most often they are not in the early stages. Internal validity gets added as a natural part of the research project (think developments in the theory of evolution); trying to force internal validity is a mistake that will rapidly push a theory away from science and into the realm of pseudo-science. Let it happen naturally as more observations come in and more parts of the theory are tested more rigorously.

As a side note, I do have to express my dissatisfaction with the emphasis on experiments, no one disputes that astronomy is a science and experiments are very rarely possible. Testable predictions and observations are the true benchmark, in astrophysics if I predict a black hole will show up in certain conditions and further observations do indeed confirm that black holes do show up in those conditions I've successfully made a testable hypothesis and confirmed it without experimentation, if it doesn't show up than I have evidence against my hypothesis. Same thing with economics.

Monday, October 14, 2013

There's No Evidence of Increasing Dependency! Why Don't People Get This?!?!?!

Sorry for the long blogging silence, I was trying to juggle long hours with a full time course load while planning a wedding and looking for a house. I've now cut back so should have some time for blogging again.

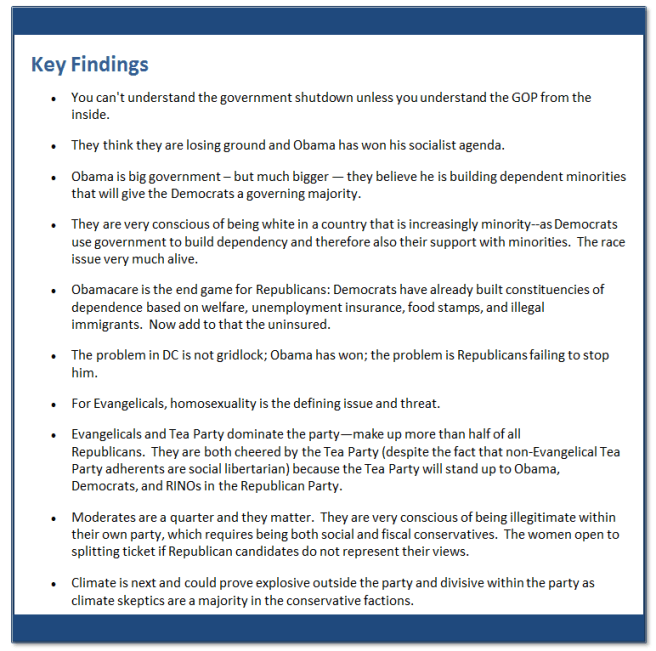

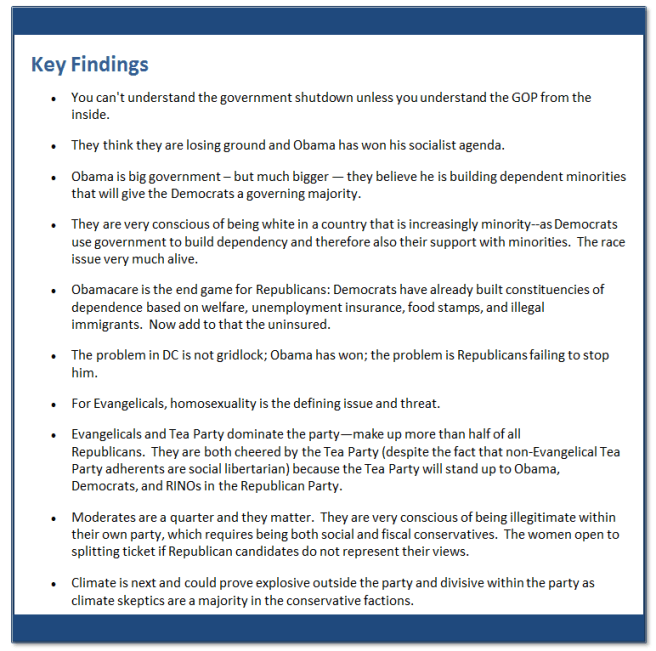

I was reading a post by Rod Dreher on the Republican Party and the shutdown. He posted a summary of findings from a report on the Republican Party base. A shocking number of the bullet points had to do with something that there is no evidence for (link to the full report):

I wrote a rather lengthy page on dependency a while back. I'm not aware of any empirical evidence of this phenomenon or any strong theoretical argument for it. Yet, dependency is mentioned in three of the bullet points for right wing motivations.

It's insane. Increasing dependency is a fantasy. Opposing dependency gets you fantasy policies that can't achieve anything because it's not a problem that shows up in the data. Government benefits aren't tied to any real increases in dependency (you can make a theoretical argument for Social Security and those over 65, but employment by those over 65 is increasing not decreasing so this isn't a very strong argument).

What it appears to be is a rationalization. These folks are having trouble grappling with the social and demographic changes of the last 50 years. Rather than attributing these changes to the market and to other uncontrollable factors they seek to attribute the changes to the policy responses that seek to deal with them.

This makes it very difficult to deal with these people. They are caught up in reverse causation, the more you do to mitigate the impacts of these social pressures the more opposed they will become to any further efforts to mitigate them sense they see the response as the cause (they need to learn sequencing). Let these changes go unaddressed and the resulting problems will get them even more riled up. If they ever get their way they will also just get angry, unmitigated these problems will get vastly worse and they'll double down on their ineffectual actions.

The sad fact is that there is little that can be done but ignore these folks and seek to isolate them. They don't understand the wider social forces impacting their lives and feel powerless to act against them. They aren't, but since they are not comfortable with the policy tools or coordination necessary to deal with the problems they've identified there isn't any meaningful way to engage with them. They mistake solutions for the causes of the problems and they are focused on attacking the solution because they mistake it for the cause. It's just hopeless.

It also reminds me of the deep problem of democratic theory. How can someone opposed to democratic ideals and norms be properly represented in a democratic polity? If you don't represent them you violate the principle of representation, if you do represent them they violate the very ideals and norms you are trying to protect by representing them.

I was reading a post by Rod Dreher on the Republican Party and the shutdown. He posted a summary of findings from a report on the Republican Party base. A shocking number of the bullet points had to do with something that there is no evidence for (link to the full report):

I wrote a rather lengthy page on dependency a while back. I'm not aware of any empirical evidence of this phenomenon or any strong theoretical argument for it. Yet, dependency is mentioned in three of the bullet points for right wing motivations.

It's insane. Increasing dependency is a fantasy. Opposing dependency gets you fantasy policies that can't achieve anything because it's not a problem that shows up in the data. Government benefits aren't tied to any real increases in dependency (you can make a theoretical argument for Social Security and those over 65, but employment by those over 65 is increasing not decreasing so this isn't a very strong argument).

What it appears to be is a rationalization. These folks are having trouble grappling with the social and demographic changes of the last 50 years. Rather than attributing these changes to the market and to other uncontrollable factors they seek to attribute the changes to the policy responses that seek to deal with them.

This makes it very difficult to deal with these people. They are caught up in reverse causation, the more you do to mitigate the impacts of these social pressures the more opposed they will become to any further efforts to mitigate them sense they see the response as the cause (they need to learn sequencing). Let these changes go unaddressed and the resulting problems will get them even more riled up. If they ever get their way they will also just get angry, unmitigated these problems will get vastly worse and they'll double down on their ineffectual actions.

The sad fact is that there is little that can be done but ignore these folks and seek to isolate them. They don't understand the wider social forces impacting their lives and feel powerless to act against them. They aren't, but since they are not comfortable with the policy tools or coordination necessary to deal with the problems they've identified there isn't any meaningful way to engage with them. They mistake solutions for the causes of the problems and they are focused on attacking the solution because they mistake it for the cause. It's just hopeless.

It also reminds me of the deep problem of democratic theory. How can someone opposed to democratic ideals and norms be properly represented in a democratic polity? If you don't represent them you violate the principle of representation, if you do represent them they violate the very ideals and norms you are trying to protect by representing them.

Subscribe to:

Comments (Atom)